Do you love your family? This Valentine’s Day, protect them with a steady source of passive income.

What is Passive Income?

Regular earnings derived from a source that does not require much effort.

Examples - rental income, dividends earned from stocks, & etc.

Why Passive Income?

“Don’t let making a living prevent you from making a life.” — John Wooden

1. Financial freedom - you and your family will never have to rely on a pay check.

2. Retire Early - it is generally possible to retire when you have regular source of income to meet your needs.

3. Live anywhere - when you have a regular source of income, you will have the freedom to live life anywhere.

4. Focus on what you love- you can afford to spend time on activities you cherish more.

5. Lack of stress and fear of future - you will no longer have to fear a future with no regular income. As a result, you will have a better temperament.

How to Create a Passive Source of Income?

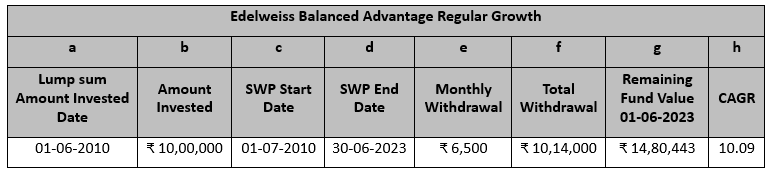

There are several ways to create a passive source of income but here is a live example of an investor who has made a Lump-sum Investment of Rs 10 Lakhs and opted for a Systematic withdrawal Plan (SWP option in Mutual fund) of Rs. 6,500/- per month that equates to SWP @ 7.8 % per annum from 1st Jan 2010 till 1st June 2023. Despite having withdrawn around Rs. 10,14,000 over a 13-year period, the current value of the fund is around Rs. 14,80,443.

Note - Please note that Mutual Funds are subject to market risks. The scheme along with the performance is for illustrative purposes only. Kindly contact us.

The combination of capital appreciation and regular income makes this a better option than Fixed Deposits. Therefore, it leaves with a chance to also create a legacy for your family.

Aren’t you excited to know more? Well, contact us at support@finhancers.com or +91 88840 03034 or fill the below form and we shall get in touch with you - https://bitly.ws/34Kmw

Source: Finhancers.com